Business members who thrived in 2021

Local businesses are the backbone of the British Columbia economy, and at Prospera we believe that when local businesses succeed, our communities thrive. Here are just a few of the stories that inspired us in 2021.

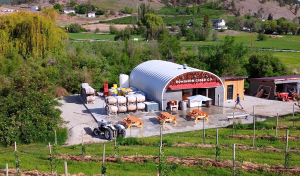

Dominion Cider

Watch the video

José & Co. Custom Jewellers

Watch the video

Senior Services Society of BC

Watch the videoKey Results

Lines of Business

To help you reach your financial goals, Prospera has over 650 employees across three lines of business and several corporate support areas.

Business Banking

Business Banking at Prospera supports 14,000 local business owners and includes three divisions: Local Business, Core Commercial, and Real Estate Development.

2021 highlights included:

With Prospera’s merger, they now have additional lending capacity to support my business, including offering higher loan limits that have allowed us to grow our business and finance larger constructions projects. I’m grateful for their partnership and responsiveness to my business needs.

Leasing

WSL, Prospera’s Auto Leasing Division, gives us a national presence in consumer and commercial vehicle, equipment, and fleet leasing across Canada. Mercado Capital Corporation is our is our business equipment leasing division that has customers across the country.

2021 highlights included:

I wanted to increase the rental space on my property and had the option of financing through my mortgage, but I didn’t want to use up the equity. Understanding my business, the Prospera team offered a meeting with their Leasing division, which became available after the merger and we finalize the terms and I’m super excited about this new addition to the property.

Personal Banking

In 2021, a core priority was to ensure that all members could be served across all locations with their most commonly requested transactions, a key commitment arising from the 2020 merger.

2021 highlights included:

In these days of unrest and increasing difficulties in negotiating the simplest of contracts, it is an absolute joy to work with people such as Prospera. Your whole team was involved in the support and efforts to get my grandchildren their first home. I am not only greatly relieved, but proud to think of you all as truly our financial family!

Wealth Planning

Prospera’s dedicated team of wealth management professionals provide expert advice to help clients plan for their future. They help clients and members with financial planning, estate planning, tax planning, income protection, and investment management.

2021 highlights included:

Although, we’ve only known our advisor for a relatively short time, we feel we have a solid relationship. We trust the advice we’re given and appreciate the way our advisor is able to clearly explain things to us.

Member Service Centre

In 2021, our two Member Service Centres provided a wide range of banking and lending solutions.

2021 highlights included:

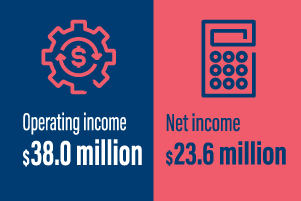

2021 Financial highlights

Communities and Local Good

The Prospera Foundation’s funding is now extended to support businesses, families, and youth in need across our trade areas, reaching from Metro Vancouver to the Fraser Valley, and into the Okanagan. In 2021, Prospera also launched a new community investment strategy, which identified three new giving areas: local business, preventative health, and education.